The Latest API Security Trends in the Financial Sector: A CISO’s Perspective

As a former CISO and security executive in the financial services industry, I’ve witnessed firsthand the rapid evolution of the threat landscape and the challenges that come with securing APIs in this sector. APIs are officially the backbone of our digital world, enabling financial institutions to innovate and deliver seamless experiences to customers. However, with this growth comes a new set of security risks that we simply cannot ignore.

Unveiling API Security Trends in the Financial Sector

Last year, Traceable released the industry’s first and only comprehensive study, “The 2023 Global State of API Security.” This groundbreaking report highlighted the growing importance of APIs in modern application architectures and the increasing threats they face. The study underscored the need for organizations across industries to prioritize API security and adopt a comprehensive approach to mitigate the risks associated with API attacks and vulnerabilities.

Building upon the success of our global study, we recognized the critical need to thoroughly understand the specific challenges faced by the financial services sector. Financial institutions have become prime targets for cyber attackers, with APIs serving as a primary vector for these threats.

Our latest report, “The State of API Security in Financial Services,” reveals alarming findings that should serve as a wake-up call for the industry. The rapid adoption of APIs in the financial sector, driven by the need for innovation, open banking initiatives, and the demand for seamless customer experiences, has exponentially expanded the attack surface, making it non-negotiable for organizations to address the unique security challenges posed by APIs in this critical industry.

Compliance Concerns: Balancing Act

The report highlights that financial organizations are still struggling with basic challenges, especially compliance. A staggering 82% of financial institutions express moderate to extreme concern about complying with federal financial regulations, including the FFIEC, OCC, and CFPB, in relation to their API inventory and security posture.

In October 2022, the FFIEC released updated guidance on the authentication and access to financial institution services and systems, emphasizing the importance of inventory, risk assessment, and strong authentication and access management controls, particularly in the context of APIs. This update underscores the growing regulatory focus on API security and the need for financial institutions to prioritize compliance in this area.

Additionally, 76% indicate moderate to extreme concern regarding PCI-DSS compliance as it relates to API security. Balancing these compliance demands with the complexities of API security is a delicate act that requires constant vigilance.

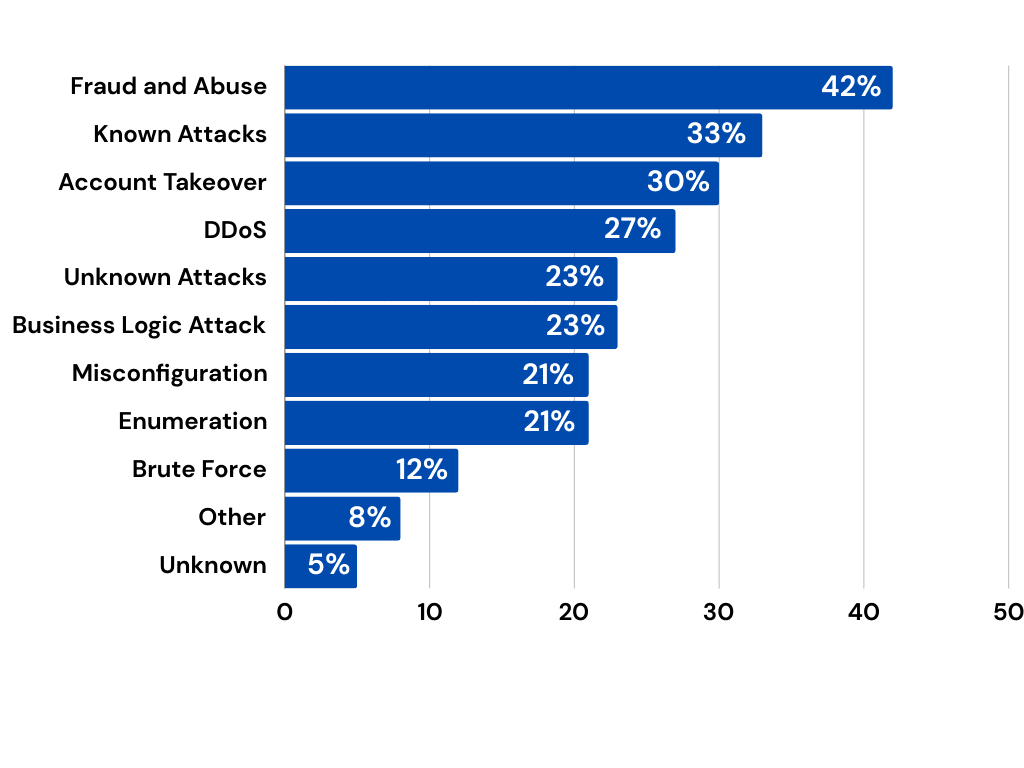

Fraud and Abuse: The Root Cause of 42% of API-Related Breaches

One of the most troubling findings is that 42% of respondents who experienced an API-related data breach cite fraud, abuse, and misuse as the root cause. Furthermore, only 15% of organizations are extremely confident in their ability to detect and prevent API-based fraud and abuse.

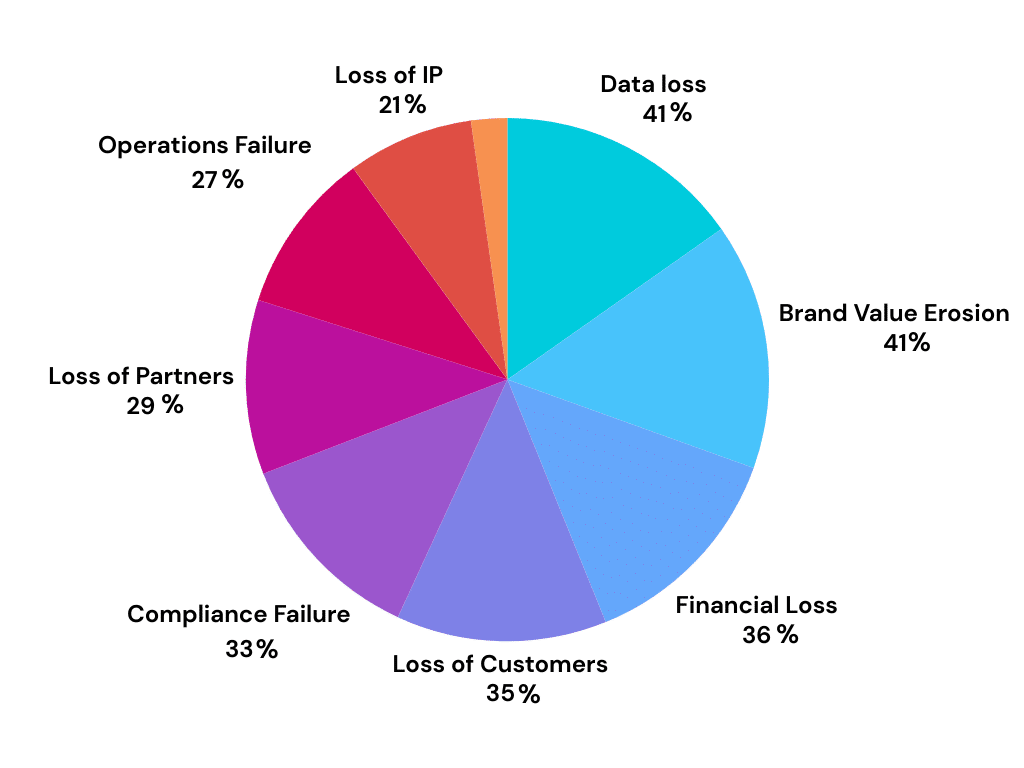

The High Cost of API Breaches

The consequences of API-related breaches in the financial sector are far-reaching, with data loss and brand reputation damage topping the list at 41% each, followed by financial loss (36%) and customer attrition (35%). A single API breach can erode customer trust, lead to significant financial losses, and damage an institution’s reputation for years to come.

The Critical Role of API Context

Another critical finding from our report is that 64% of financial institutions lack the ability to understand the context between API activity, user activity, data flow, and code execution. This lack of contextual understanding is a major blind spot in API security, making it difficult for organizations to detect and respond to API-based threats effectively. Without the ability to correlate API activity with user behavior, data flow, and code execution, financial institutions are left vulnerable to sophisticated attacks that can easily evade traditional security measures.

Contextual awareness is crucial for identifying anomalous behavior, detecting threats, and preventing data breaches. As financial institutions continue to adopt APIs at an accelerated pace, it is imperative that they invest in solutions that provide context across their API ecosystem.

Join Us for a Full Analysis of API Security Trends in Financial Services

To further explore the findings of our report and discuss strategies for strengthening API security in the financial sector, I invite you to join me for an exclusive webinar on June 17th at 10 am PT. During this session, we’ll cover the latest trends, challenges, and best practices for securing APIs in financial services.

The Bottom Line: API Security is a Business Risk

As security leaders, it’s our job to protect our organizations’ assets and our customers’ data, while ensuring compliance with ever-evolving regulations. We can’t afford to be caught off guard by the growing threats of fraud and malicious bots that are constantly looking for ways to exploit API vulnerabilities and steal sensitive data.

The stakes are high, and the trust that our customers and partners place in us is not something we can take for granted. We must step up and lead the charge in securing our API ecosystems.

Together, we can build a stronger, more resilient future for financial services.

About Traceable

Traceable is the industry’s leading API Security company helping organizations achieve API protection in a cloud-first, API-driven world. Traceable is the only contextually-informed solution that powers complete API security – API discovery and posture management, API security testing, attack detection and threat hunting, and attack protection anywhere your APIs live. Traceable enables organizations to minimize risk and maximize the value that APIs bring to their customers. To learn more about how API security can help your business, visit https://www.traceable.ai/.

Richard Bird

Richard Bird