Open Banking API Security: Financial Data Sharing & Role of Open APIs

Open banking is revolutionizing the financial landscape globally, and the U.S. is no exception. With the introduction of the U.S. Open Banking Rule, we are poised to undergo a significant transformation in the financial sector. Recent developments in the U.S. regulatory landscape have brought this topic to the forefront, with the Consumer Financial Protection Bureau (CFPB) unveiling a draft rule aimed at enhancing competition and consumer control over their financial data.This rule, emphasizing the power of open APIs, offers consumers unprecedented control over their financial data, fostering innovation and competition among service providers.In this article, we delve deeper into the concept of open banking, its key features, the transformative role of open APIs, and the broader implications for the future of finance.

What is Open Banking?

Open banking is a financial services paradigm that leverages technology to provide consumers and businesses with increased control over their financial data. This system allows them to share their financial information securely with third-party developers and financial service providers. Here's a deeper dive into the concept:

Key Features of Open Banking

- Data Sharing: At the core of open banking is the idea that consumers and businesses should be able to share their financial data with third-party providers (TPPs) securely. This is facilitated through open APIs, which are sets of rules and protocols for building and interacting with software applications.

- Consumer Control: Open banking empowers consumers, giving them control over who can access their financial data and for what purpose. This means they can choose to share their data with financial technology (fintech) companies, other banks, or any other TPP to access a broader range of financial products and services.

- Innovation and Competition: By allowing third parties to access financial data (with user consent), open banking fosters innovation in the financial sector. New entrants can develop novel financial products and services, leading to increased competition, better customer service, and potentially lower costs for consumers.

- Interoperability: Open banking promotes interoperability between different financial institutions and fintechs. This means that different systems and software can communicate, exchange data, and use the information that has been exchanged.

Benefits of Open Banking

- Enhanced Financial Products: With access to rich financial data, fintechs and other TPPs can create more tailored and innovative financial products and services, from budgeting apps to more competitive loans.

- Better Financial Management: Consumers can get a holistic view of their finances, aggregating data from multiple banks or financial institutions in one platform or app.

- Increased Transparency: Open banking can lead to more transparent offerings in the financial sector, allowing consumers to compare and choose the best products for their needs.

- Improved Security: Contrary to some misconceptions, open banking can enhance security. With standardized APIs, there's a uniform method of accessing data, reducing the reliance on practices like screen scraping.

While open banking offers numerous benefits, it also comes with challenges. Data privacy and security are paramount. Ensuring that third parties handle user data securely and ethically is crucial. Regulatory frameworks, like the PSD2 in Europe, have been established to guide the implementation of open banking and protect consumers.Ultimately, open banking represents a shift towards a more open, interconnected, and consumer-centric financial ecosystem. It has the potential to reshape the financial services industry, offering consumers more choice, better services, and enhanced control over their financial data.

The CFPB's Proposal

The CFPB's proposal, known as the "open banking draft rule," seeks to empower consumers by allowing them to easily transfer their data between financial service providers. This move is expected to intensify competition, enabling customers to switch providers more effortlessly if they're dissatisfied with their current service.The proposed rule, termed the Personal Financial Data Rights rule, is designed to activate the dormant Section 1033 of the Dodd-Frank Act. This means that financial service providers will be mandated to share data, as directed by the user, with other companies in the ecosystem that might offer more competitive products and services.

The Role of Open APIs

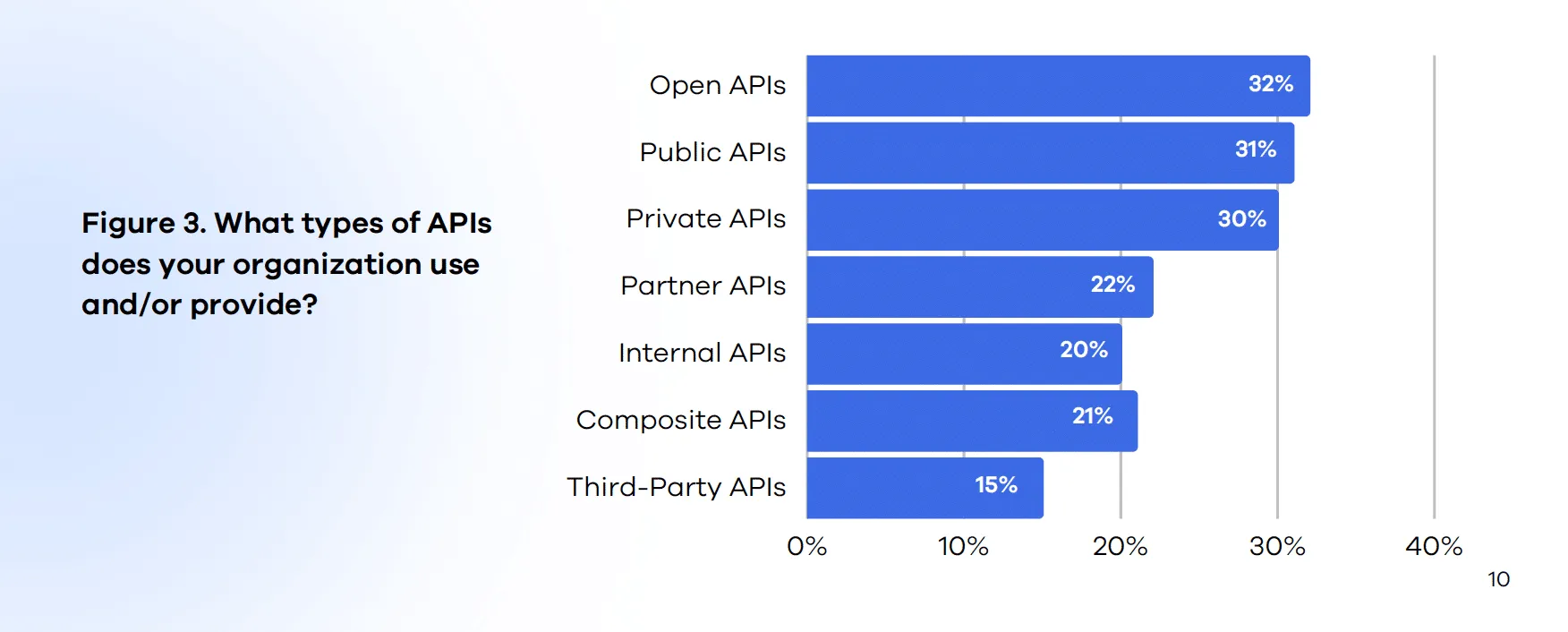

At the heart of this transformation lies the technology of open APIs. These digital gateways are the linchpins that make seamless data sharing possible, connecting various financial entities and enabling a more integrated and consumer-centric financial ecosystem.Open APIs are not just technical jargon; they represent a democratization of financial data. By allowing different software applications to communicate with each other, open APIs enable consumers to have a consolidated view of their financial data, irrespective of where it resides. This means that a consumer could potentially view their bank account details, credit card transactions, and investment portfolios all in one app, thanks to the interoperability facilitated by open APIs.And they are already prominently used by organizations. According to Traceable's State of API Security, the majority of organizations (32%) are using open APIs, making it the top choice among all types of APIs.

In the context of the Open Banking Rule, data providers, which encompass entities offering credit, debit, prepaid, or deposit account services, play a pivotal role. They're expected to provide access to all transactions from the past year, including the latest card authorizations, through these open APIs. This transparency extends to any associated fees, yield, or rewards data, and even account verification details like name and email.Authorized 3rd parties, which include apps or services like Fintech wallets or Neobanks, leverage these open APIs to access and process this data, offering consumers more tailored financial products and insights. Data aggregators, such as Plaid, MX, and Finicity, further harness the power of open APIs to connect to multiple data providers through a single interface, simplifying the data retrieval process.The positives of open APIs are clear. For consumers, it means more choice, better financial products, and a more holistic view of their finances. For financial institutions and fintechs, it translates to innovation, the ability to offer more personalized services, and the potential to tap into new revenue streams. However, with great power comes great responsibility. The seamless flow of data raises concerns about security, privacy, and data misuse. Hence, the Open Banking Rule emphasizes the transparent use of data, standardized security protocols, and clear policies.The standards body, such as the Financial Data Exchange (FDX), ensures that these open APIs adhere to technical standards and that the interests of all ecosystem participants are balanced. Their role is crucial in ensuring that open APIs are used ethically, securely, and to the benefit of all stakeholders.

The Bottom Line

While the rule is still in the proposal phase, its potential implementation could revolutionize the U.S. financial sector. The timeline suggests a phased approach based on the size and revenue of institutions. But one thing is clear: open APIs, as the backbone of this transformation, are set to redefine the future of finance in the United States. Moreover, the global nature of open APIs means that the benefits aren't confined to the U.S. alone. As more countries adopt open banking regulations and standards, we're likely to see a global financial network where data flows freely across borders, fostering global partnerships and offering consumers numerous choices.

The Inside Trace

Subscribe for expert insights on application security.

.avif)